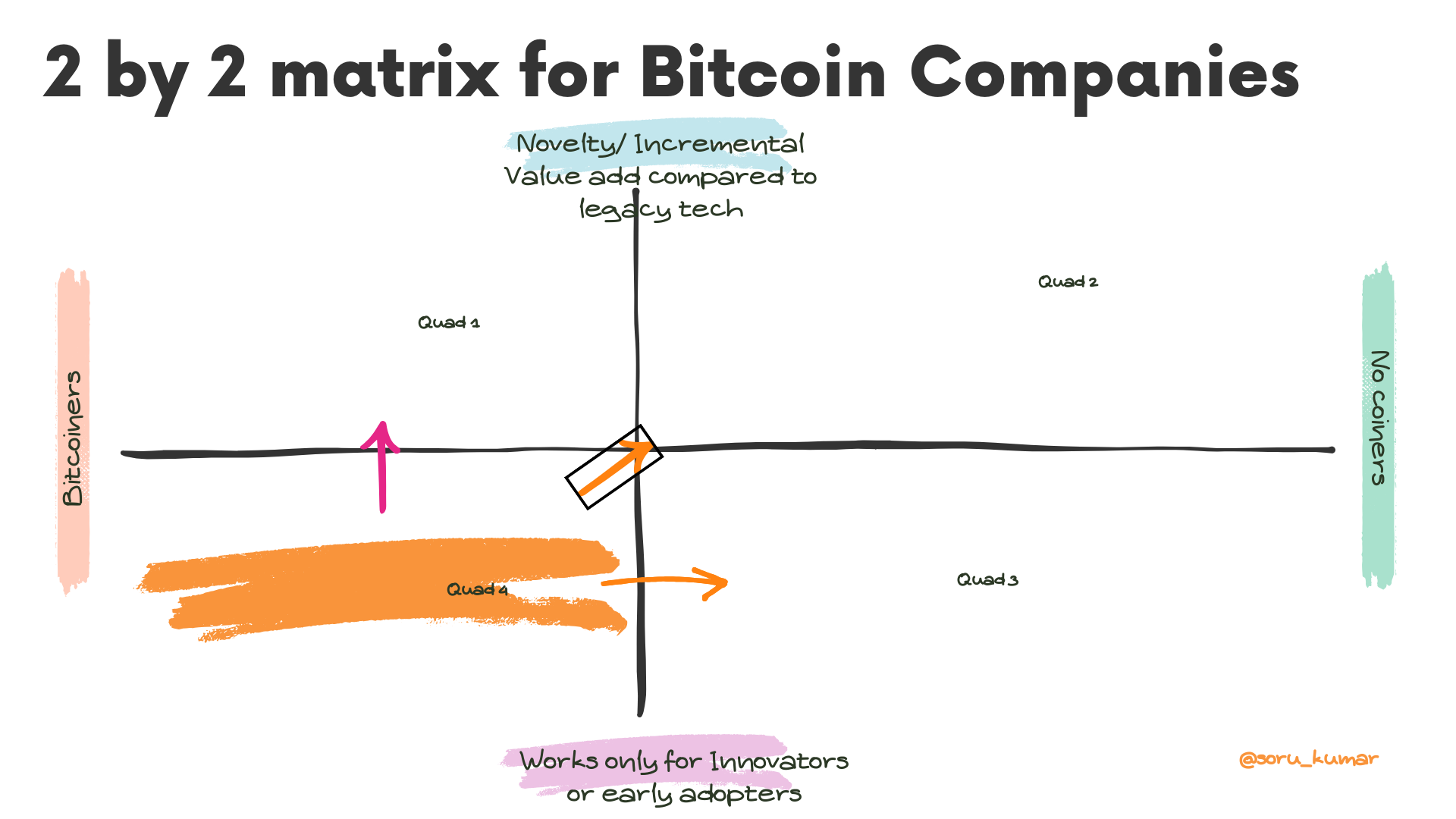

A framework (2 by 2) to understand Bitcoin & Lightning Companies

Here is 2 by 2 framework to look at a Bitcoin start-up that is useful and insightful.

First, I’ll lay out the framework, and then we’ll go deeper into why it is useful, even though it is simple. This lens to look at companies works for startup founders, employees & VCs.

X-Axis: Bitcoiner and No Coiners. Who the business is Targeting?

It is an important dimension because there is no other lens to look at a Bitcoin business that tells us more about its users, and their needs and behavior. A Bitcoiner is a different species from no coiners, and they are similar in thousands of ways.

Why does segmenting based on who they are targeting make sense?

Target customers define how the company communicates, behaves, and builds. Just look at the Twitter feed of a Bitcoin company, and you will know who they are talking to. The language and memes that work for Bitcoiners are alien to far-right no-coiners. Companies that are targetting ‘no coiners’ customers, consumers, or businesses, to the chagrin of Bitcoiners talk in a ‘new’ language. For example, compare the communication of LightSpark and others in the same category.

Now, this lens works for VC and employees too. It gives a pulse on the clarity of thought of the founders and company. If a company’s product is more in line with no coiners, but they are talking in bitcoin meme, more likely than not, they won’t be able to run a successful business. Likewise, If a company’s product is geared towards hard-core bitcoiners, and they talk in a normie language, it is not a good sign.

For startup founders, this lens provides useful insight into what they should build. For someone with a decade of experience in the Web 2 world, where they have hardly interacted with Bitcoiners, it is not wise to build a ‘Bitcoiner’ only product. The wisdom is you build for yourself and a user base that you understand.

Lastly, it is even better to consider this dimension a continuous variable, rather than a categorical one. As we all know, not all Bitcoiners are the same, and not all no-coiners are the same. And, we all are at different stages in terms of understanding Bitcoin.

Y-Axis: Novelty/Incremental value add compared to legacy tech

As the tech wisdom goes, to beat an incumbent you need to come up with 10x better product. Considering bitcoin is a novel technology, we can argue any company that uses bitcoin is bringing novelty to the product.

But, for the sake of this dimension, merely using a new technology is not a novelty. The tech has to manifest into a more usable & valuable product.

For the remittance use case, it would be faster, cheaper, and easy to use. The sovereign money feature would be considered a 10x addition, only for products and the user base who value it. For a product category (e.g. online learning marketplaces like Udemy) where censorship-resistant and decentralization are not core needs of users (top 10 needs), launching a product and adding an LN payment layer is not a novelty. However, in some cases, it is still okay, when the company is targeting hard-core bitcoin native users. With every cycle, the base is growing, so there is opportunity for companies to grow, if not exponentially.

Note:

- In future posts, I’ll look to apply the framework to a couple of companies from ‘The Lightning Network Industry Market Map’ by River

- 2nd, Bitcoin is an emerging technology, and perhaps we are still in the process of constructing a robust infrastructure. So, its not smart to be overly critical on value add dimension.

- Their is non-zero likelihood that the use case for the sovereign money is enough, and with changing world order and dynamics, the use case is enough to propel it to mainstream adoption.